Why Elder Care Collective?

Welcome to the Elder Care Collective where we help children plan for taking care of their parents and help those getting older become more wiser!

***New Offering*** Necessity Concierge Services

In response to a high demand to bridge an immediate gap of sustainable healthy living in times of crises, we have added care placement, errand running and custom meal planning/preparation.

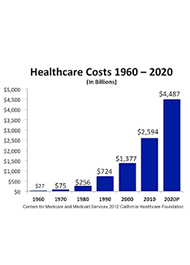

Don't Go Broke Too often people plan for life and death and not the in-between. The in-between hopefully can be long and stress-free with no medical or health scares. But for many the in-between is the unimaginable where disease, temporary health challenges or memory loss can modify the ability to handle normal living or take care of their affairs. The Elder Care Collective focuses on helping bridge the gap in-between and help you and your family members live your best life to the fullest without the financial worries. We focus on getting the most qualified home healthcare assistance with the least amount of money. With over 25 years of experience in modeling the right unique plan for independent elders who don't want to burden their family members or family members who need to plan appropriately for the timing of a college student and a sick parent, we have an Elder plan collectively created for you!

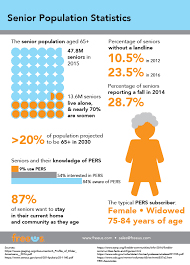

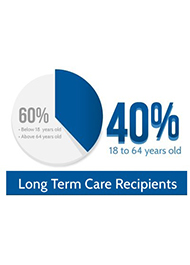

According to the study, "Older Americans 2000: Key Indicators of Well-Being," more than 35 million people in the United States are over 65 which accounts for 13 percent of the total population. With the aging of baby boomers, born between 1946 and 1964, America's older population will double by 2030, reaching some 70 million. Life expectancy for Americans age 65 in 2000 is 18 years, on average. About 4 percent of the population 65 and older, some 1.46 million people, were in nursing homes in 1997. About 192 out of every 1,000 people aged 85 or older were in nursing homes in 1997. The rate for this group in 1985 was 220 per 1,000.

People are living longer which has also created a need to either work longer or plan more prudently on how to sustain a life into the golden years. The vast majority of people over 35 fall into one of the following categories: a) parents get older and need supplemental home/health assistance but also have responsibilities for immediate family and career, b) life changes have necessitated home/jhealthcare needs for the elderly that are not met by standard health insurance and c) family members/friends who don't know how to get assistance for someone in need. Find out more by joining the list of people who are excited about the benefits of signing up for The Elder Collective services. Need help and don't know where to start? Complete the following form and one of our advisors

will contact you within 24 hours or call 1-800-345-9397.